All About Corporate Voluntary Agreement (CVA): Meaning and Use.

All About Corporate Voluntary Agreement (CVA): Meaning and Use.

Blog Article

Ultimate Guide to Recognizing Business Voluntary Arrangements and How They Profit Companies

Business Volunteer Arrangements (CVAs) have become a tactical device for organizations looking to browse economic challenges and restructure their operations. As the company landscape proceeds to progress, recognizing the details of CVAs and how they can positively impact companies is important for notified decision-making.

Comprehending Company Volunteer Arrangements

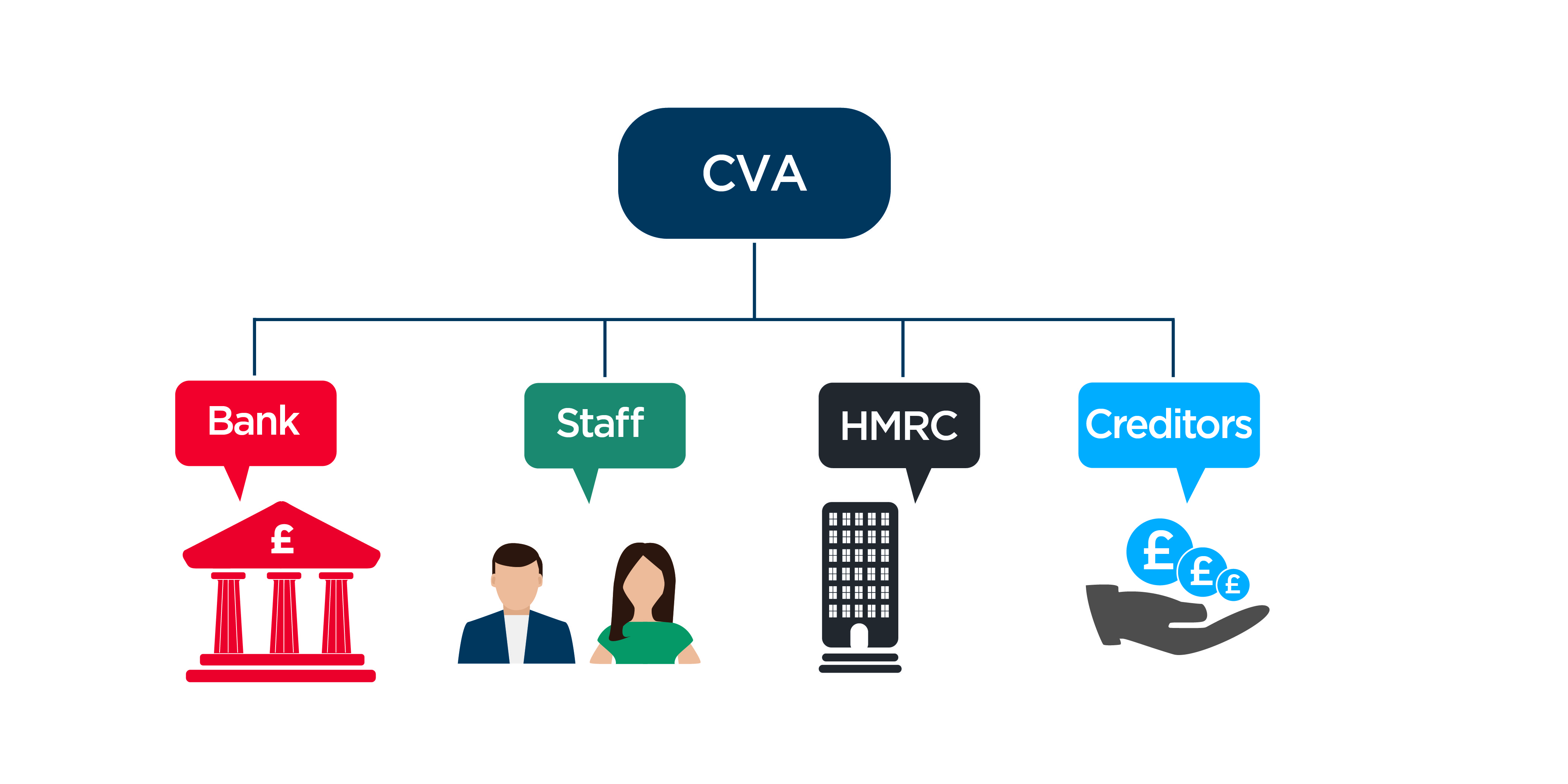

In the world of company administration, a basic idea that plays a critical role fit the relationship between firms and stakeholders is the detailed system of Business Voluntary Contracts. These contracts are volunteer commitments made by firms to adhere to specific standards, techniques, or goals past what is legitimately required. By participating in Company Voluntary Arrangements, business demonstrate their dedication to social responsibility, sustainability, and moral business techniques.

One secret element of Corporate Volunteer Arrangements is that they are not lawfully binding, unlike regulative needs. Companies that voluntarily commit to these contracts are still expected to support their pledges, as stopping working to do so can result in reputational damage and loss of stakeholder trust fund. These contracts often cover areas such as environmental defense, labor rights, diversity and inclusion, and community engagement.

Benefits of Business Volunteer Agreements

Moving from an expedition of Corporate Volunteer Agreements' value, we now turn our attention to the tangible benefits these agreements supply to firms and their stakeholders. Among the primary benefits of Business Volunteer Contracts is the chance for business to restructure their financial debts in an extra workable method. This can assist reduce monetary problems and prevent possible insolvency, permitting business to proceed operating and possibly prosper. In addition, these contracts supply an organized framework for arrangements with financial institutions, fostering open communication and cooperation to get to mutually useful remedies.

Moreover, Corporate Voluntary Contracts can improve the business's credibility and connections with stakeholders by showing a commitment to attending to monetary challenges responsibly. By proactively looking for options through voluntary contracts, businesses can display their commitment to maintaining and fulfilling obligations trust fund within the industry. Moreover, these arrangements can supply a level of discretion, enabling companies to resolve monetary troubles without the public scrutiny that may accompany various other restructuring options. Overall, Business Voluntary Arrangements work as a critical tool for firms to navigate monetary obstacles while preserving their procedures and relationships.

Refine of Applying CVAs

Comprehending the procedure of carrying out Corporate Volunteer Agreements is important for firms seeking to navigate financial obstacles successfully and sustainably. The primary step in executing a CVA entails selecting a licensed insolvency practitioner that will function very closely with the company to evaluate its monetary circumstance and viability. This preliminary analysis is critical in determining whether a CVA is one of the most suitable service for the business's monetary problems. Once the choice to wage a CVA is made, a proposition outlining exactly how the company intends to repay its creditors is drafted. This proposal has to be authorized by the business's creditors, that will certainly elect on its approval. If the proposition is accepted, the CVA is executed, and the business has to stick to the agreed-upon settlement plan. Throughout the execution procedure, regular interaction with financial institutions and thorough economic monitoring are key to the effective implementation of the CVA and the company's eventual monetary recovery.

Trick Considerations for Companies

One more crucial factor to consider is the degree of transparency and interaction throughout the CVA procedure. Open and honest communication with all stakeholders is important for constructing depend on and making certain a smooth application of the agreement. Organizations must additionally take into consideration looking for specialist guidance from monetary experts or lawful specialists to browse the complexities of the CVA procedure efficiently.

Furthermore, businesses need to analyze the lasting effects of the CVA on their track record and future funding opportunities. While a CVA can give immediate alleviation, it is necessary to assess how it might affect connections with creditors and financiers in the long run. By meticulously considering these essential aspects, companies can make enlightened choices concerning Corporate Voluntary Contracts and establish themselves up for a successful financial turnaround.

Success Stories of CVAs at work

Numerous organizations have effectively implemented Company Volunteer Contracts, showcasing the effectiveness of this financial restructuring device in rejuvenating their procedures. By getting in right into a CVA, Company X was able to renegotiate lease agreements with landlords, lower overhead costs, and restructure its financial debt commitments.

In one more instance, Business Y, a production firm strained with tradition pension responsibilities, made use of a CVA to restructure its pension commitments and improve its operations. Via the CVA procedure, Firm Y achieved considerable price financial savings, boosted its competitiveness, and secured long-lasting sustainability.

These success tales highlight just how Business Volunteer Arrangements can supply having a hard time businesses with a viable path in the direction of economic healing and operational turn-around. By proactively attending to economic obstacles and restructuring obligations, companies can emerge stronger, a lot more active, and much better placed for future growth.

Verdict

In verdict, Corporate Volunteer Agreements use companies a structured technique to dealing with monetary problems and restructuring financial debts. By applying CVAs, firms can stay clear of insolvency, protect their assets, and maintain connections with lenders. The process of applying CVAs entails mindful planning, arrangement, and dedication to meeting agreed-upon terms. Companies have to consider the prospective benefits and drawbacks of CVAs before choosing to seek this alternative. Overall, CVAs have verified to be reliable in aiding services what is a cva in business overcome monetary difficulties and achieve long-lasting sustainability.

In the world of business governance, an essential idea that plays an essential function in forming the partnership in between companies and stakeholders is the intricate device of Business Volunteer Contracts. corporate voluntary agreement. By getting in right into Business Volunteer Arrangements, business show their commitment to social responsibility, sustainability, and moral company practices

Relocating from an exploration of Business Voluntary Contracts' relevance, we now turn our focus to the concrete benefits these contracts offer to companies and their stakeholders.Additionally, Company Voluntary Contracts can improve the company's track record and partnerships with stakeholders by demonstrating a commitment to resolving financial difficulties properly.Comprehending the procedure of carrying out Business Volunteer Agreements is necessary for business seeking to navigate financial difficulties successfully and sustainably.

Report this page